Comparables (or "comps") are recently sold homes similar to your property in location, size, condition, and features—they're the foundation of determining what a home is truly worth in today's market.

Quick Answer: What You Need to Know About Comparables

- Definition: Properties used to assess fair market value by comparing similar characteristics

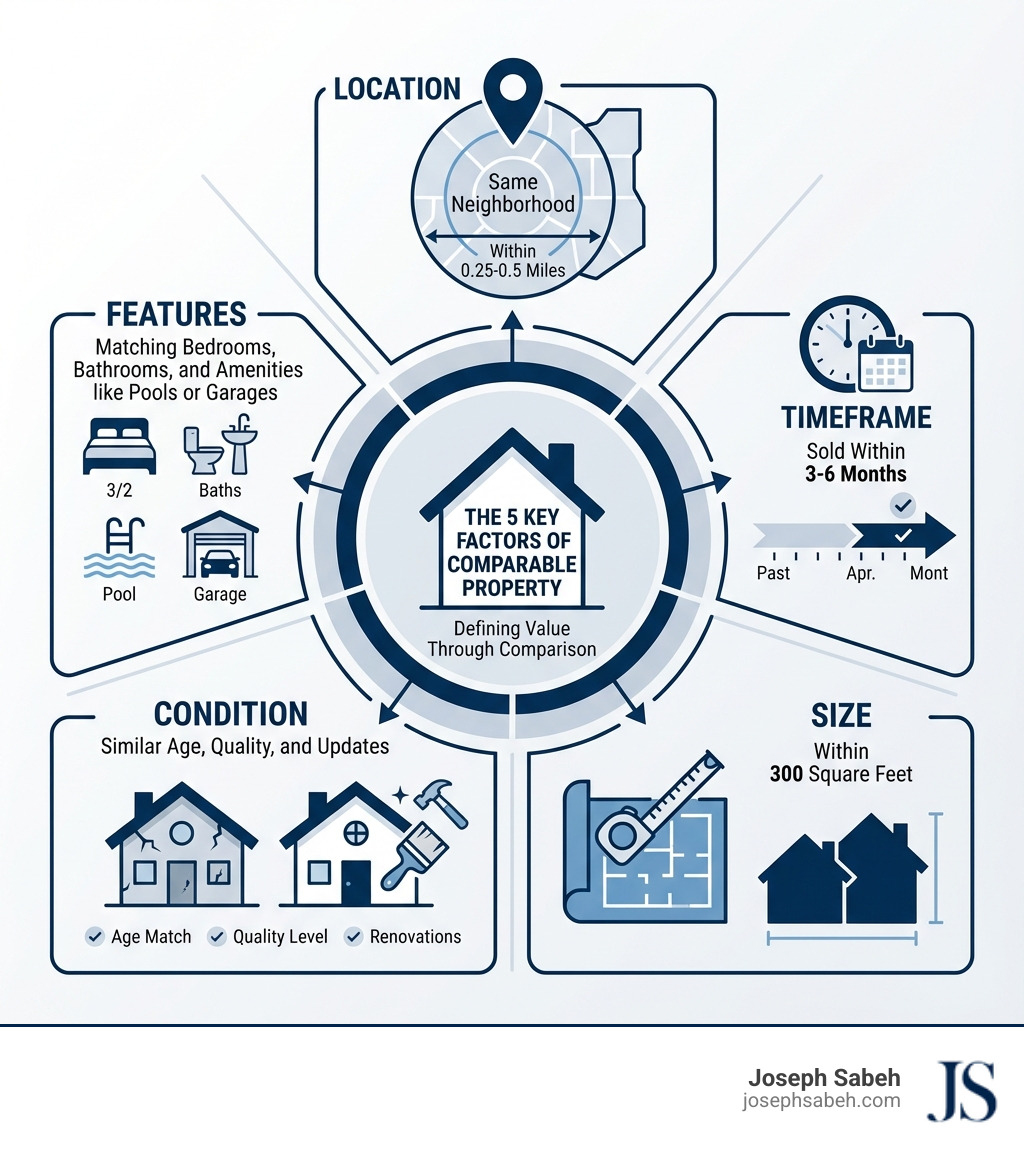

- Key Criteria: Location (0.25-0.5 mile radius), timeframe (3-6 months), size (within 300 sq ft), condition, and features

- Who Uses Them: Buyers (to make offers), sellers (to set prices), appraisers (to confirm value), and agents (to create market analyses)

- Minimum Needed: At least 3 comps, ideally 4-6 for accurate valuation

- Where to Find: MLS databases, public records, county assessor offices, and online platforms like Zillow or Realtor.com

Whether you're buying your dream home in Fremont's competitive market, selling a luxury property in Pleasanton, or navigating a refinance, understanding comps is your first step toward making informed decisions. In the Bay Area's fast-moving real estate landscape—where homes can vary by hundreds of thousands of dollars within a few blocks—knowing how to identify and analyze comparable sales isn't just helpful, it's essential.

The principle is simple: a buyer won't pay more for your home than they would for a similar one down the street. This concept, called the principle of substitution, drives every real estate transaction and property valuation.

But here's where it gets tricky. Not all comparables are created equal. A home sold six months ago might not reflect today's market. A similar-sized house on a busy street isn't truly comparable to one on a quiet cul-de-sac. And those online estimates? They can be off by nearly 7% for off-market homes, according to Zillow's own data.

The Foundation of Valuation: What Are Real Estate Comparables?

At its core, a comparable is a recently sold property that shares enough characteristics with your "subject property" (the one you're interested in valuing) to provide a reliable benchmark for its market value. Think of it as finding a twin, or at least a very close cousin, in the real estate family.

The concept of comparables is rooted in the "principle of substitution," which posits that a buyer will not pay more for a property than the cost of acquiring an equally desirable substitute property. This principle forms the bedrock of real estate valuation, guiding everything from a quick market analysis to a formal appraisal.

In a dynamic market like the Bay Area, where property values can fluctuate based on micro-neighborhood trends, school districts, and even specific street appeal, identifying accurate comparables is a nuanced art and science. It’s what allows us to understand the pulse of the market and make informed decisions, whether we're buying, selling, or simply curious about our home's worth.

To truly master this skill, it's helpful to understand how to find these crucial data points. For a deeper dive into the mechanics, explore How to Find Comparables in Real Estate for Accurate Home Valuations.

Why Comps are Crucial for Buyers, Sellers, and Appraisers

Comparables aren't just a buzzword; they're the language of real estate valuation, spoken by everyone involved in a property transaction.

-

For Buyers: Making a Smart Offer As a buyer, understanding comparables empowers us to make a competitive, yet fair, offer. We don't want to overpay, especially in a hot market, but we also want our offer to be taken seriously. By analyzing recent sales of similar homes, we can confidently determine an appropriate price range, ensuring we're not just guessing. This knowledge can be the difference between securing your dream home in Danville or watching it slip away.

-

For Sellers: Pricing Your Home Right For sellers, comparables are the key to setting an accurate and attractive listing price. Price too high, and your home might sit on the market, gathering dust and skepticism. Price too low, and you leave money on the table. We use comparables to strategically position your home within the market, attracting the right buyers and minimizing time on the market. It's about finding that sweet spot where value meets demand.

-

For Appraisers: Confirming Value for Lenders Appraisers are the neutral arbiters of value. When you secure a mortgage, your lender will require a professional appraisal to confirm that the property's value justifies the loan amount. Appraisers rely heavily on comparables—often sourcing them from the Multiple Listing Service (MLS)—to form their expert opinion of value. Their role is critical in ensuring the financial integrity of the transaction.

-

For Property Tax Appeals: Challenging Assessments Beyond transactions, comparables can even help us save money on property taxes. If we believe our home has been overvalued by the county assessor, we can use strong comparables to make a case for a lower assessment. According to legal experts, a difference of at least 10 percent between your home's assessed value and the value of its comparables can provide a solid foundation for an appeal. For more insights on this, refer to Using comparables to lower property taxes.

How Market Conditions Affect Comparables

The real estate market is a living, breathing entity, constantly shifting with economic winds and local dynamics. These changes directly impact the relevance and interpretation of comparables.

- Supply and Demand: In a seller's market (low inventory, high demand), prices tend to rise, and older comparablesmight quickly become outdated. Conversely, in a buyer's market (high inventory, low demand), prices might soften, making recent sales a more cautious benchmark.

- Interest Rate Impact: Fluctuations in interest rates can significantly affect buyer purchasing power. When rates rise, affordability can decrease, potentially cooling demand and impacting home values. This means a home sold when rates were low might not be a perfect comparable if rates have since jumped.

- Time on Market: How quickly homes are selling in a particular area is a vital indicator. If homes are flying off the market in a week, even a three-month-old comparable might need to be adjusted upwards. If homes are sitting for months, we need to be more conservative.

- Local Market Nuances: The Bay Area is a mosaic of micro-markets. What's happening in Fremont might differ from Pleasanton, and a few blocks can make all the difference. Our market insights for specific areas, like those found in our Fremont Market and Pleasanton Market reports, are invaluable in understanding these localized trends.

Market conditions act like a filter through which we view comparables, helping us adjust for the current economic climate and local sentiment.

A Step-by-Step Guide to Finding Reliable Comps

Finding reliable comparables is a methodical process that combines data analysis with local market knowledge. It’s not just about plugging numbers into a calculator; it’s about understanding the story behind each sale.

Here's how we approach it:

Step 1: Define Your Subject Property's Key Features

Before we can compare, we need to know what we're comparing to. This means getting intimately familiar with the subject property's specifications. We'll gather details on:

- Square Footage: This is a primary metric. We generally aim for comparables that are within about 300 square feet of the subject property's size. A 2,000 sq ft home isn't truly comparable to a 3,000 sq ft home, even if they're next door.

- Lot Size: Especially important in areas like the Bay Area where land is at a premium. A larger lot often commands a higher price.

- Number of Bedrooms and Bathrooms: These are fundamental features that significantly impact value. We look for matches here first.

- Age and Style: A mid-century modern home in Pleasanton will compare best to other mid-century moderns, not a newly built contemporary. The age often dictates construction quality, materials, and architectural style.

- Condition and Upgrades: Has the kitchen been recently renovated? Are the bathrooms updated? Does it have new flooring, windows, or a new roof? These improvements add value and must be factored in.

- Unique Amenities: A pool, a stunning view, solar panels, a detached ADU (Accessory Dwelling Unit), or even unique landscaping can make a property stand out and influence its value.

Step 2: Search for Recently Sold Properties

Once we know our subject property inside and out, we begin the hunt for its doppelgängers.

- Sold Homes vs. Active Listings: This is critical. We only use sold homes as comparables. Active listings are merely asking prices, and pending sales haven't closed yet, so their final price is unknown. Only a closed sale reflects what a buyer was willing to pay and a seller was willing to accept.

- Timeframe: 3-6 Months: The sweet spot for relevance. In a rapidly appreciating or depreciating market, even three months can be a long time. In the competitive Bay Area, we often prioritize sales within the last 3 months, extending to 6 months only if necessary to find enough suitable comparables. Sales older than six months are generally considered less reliable unless the market is exceptionally stable or data is scarce.

- Proximity: 0.25-0.5 Mile Radius: Location, location, location! We limit our search to a quarter- to half-mile from the subject property. Staying within the same neighborhood or subdivision is ideal, as factors like school district, noise levels, and local amenities can vary significantly even across a few streets.

For more detailed strategies on where to cast your net, check out 10 Best Ways to Find House Comps in My Area.

Step 3: Use Online Tools and Professional Help

While we empower our clients with knowledge, we also leverage the best tools and expertise available.

- Online Home Value Estimators: Sites like Zillow and Realtor.com offer automated valuation models (AVMs) that can provide a starting point. However, it's crucial to understand their limitations. Zillow's Zestimate, for example, has a nationwide median error rate of 1.9 percent for on-market homes, but that jumps to 6.9 percent for off-market homes. These tools are great for initial research but should not be the sole basis for pricing. For a deeper dive into the accuracy of these tools, read How Accurate Are Real Estate Value Estimators: What You Need to Know.

- Real Estate Agent's Role: This is where our expertise shines. Licensed real estate agents have access to the Multiple Listing Service (MLS), the most comprehensive and up-to-date database of property sales. We use MLS data to generate a Comparative Market Analysis (CMA), which is a detailed report that carefully analyzes recent comparables and makes adjustments to arrive at an estimated value. Our intimate knowledge of Fremont, Pleasanton, and the wider Bay Area allows us to interpret nuances that AVMs might miss.

- Appraiser's Role: For formal valuations, especially for lending purposes, a licensed appraiser is indispensable. Appraisers are independent professionals who follow strict guidelines (like the Uniform Standards of Professional Appraisal Practice, or USPAP) to provide an unbiased opinion of value. They also rely on MLS data and public records, but their analysis is more in-depth and legally binding.

How to Analyze Comps Like a Pro

Finding comparables is half the battle; analyzing them is where the real skill comes in. No two homes are identical, so we must make adjustments to their sale prices to truly compare apples to apples.

The Anatomy of a Good Comp: Key Factors to Consider

A "good" comparable isn't just similar; it's practically a clone. Here are the key factors we carefully scrutinize:

- Location: This remains paramount. The ideal comparable is in the exact same neighborhood, with similar proximity to amenities, schools, and transportation. A home on a quiet cul-de-sac will likely fetch more than an identical home on a busy street, even if they're only a block apart.

- Sale Date: As discussed, recent sales (3-6 months) are best. The fresher the data, the more accurately it reflects current market sentiment and conditions.

- Size (within 300 sq ft): We look for homes with square footage very close to the subject property. If a comparableis significantly larger or smaller, it becomes less reliable.

- Condition: This is subjective but crucial. We assess the overall condition, age of major systems (HVAC, roof), and the level of updates (kitchen, bathrooms). A beautifully renovated home will command a higher price than an identical one in original condition.

- Age: Older homes may have different construction methods, materials, and layouts compared to newer ones. We try to compare homes built in similar eras.

- Features: Number of bedrooms, bathrooms, garage spaces, lot size, presence of a pool, view, and special architectural details all play a role. We account for these differences systematically.

When comparing, we often use a "price per square foot" (PPSF) metric as a common denominator. We calculate the PPSF for each comparable and then average them to get a general idea. However, PPSF should be used with caution, as it doesn't account for all the nuances of condition or unique features. For a comprehensive approach to estimating value, see How to Accurately Estimate Home Value in Todays Market.

Spotting the Difference: Good vs. Bad Comparables

Not all sold homes are created equal, and knowing what to exclude is as important as knowing what to include.

- Distressed Sales: Foreclosures, short sales, or estate sales often sell below market value due to various circumstances. These are generally poor comparables as they don't reflect a typical arm's-length transaction.

- Different Property Type: A condo cannot be compared to a single-family home, nor can a townhouse be compared to a sprawling estate. Each property type has its own market dynamics.

- Outdated Sales: As mentioned, anything older than six months can be misleading, especially in a volatile market.

- Significant Feature Differences: A home with 5 bedrooms is not comparable to a 3-bedroom home, even if they're otherwise similar. Similarly, a home with a stunning Bay view cannot be compared to one facing a brick wall.

- Incomparable Location: A home bordering a freeway is not comparable to one on a quiet street, even if they are in the same zip code. Proximity to undesirable features (e.g., power lines, industrial areas) or highly desirable ones (e.g., parks, top-rated schools) must be considered.

As ABC News wisely pointed out, "the assessor put a value on your house by using comparables that aren't, well, comparable." This highlights the importance of discerning between useful and misleading data. If your neighbor's home just sold, that's great news, but check if it's truly a comparable before getting too excited or worried. You can read more about this in Your Neighbors Home Just Sold.

Common Pitfalls and How to Avoid Them

Even with the best intentions, it's easy to stumble when using comparables. Here are some common traps we help our clients avoid:

- Ignoring Seller Concessions: Sometimes, a seller agrees to pay a portion of the buyer's closing costs. If a home sold for $800,000 but the seller paid $15,000 in concessions, the true net sale price was $785,000. Ignoring this can inflate your perceived value.

- Overlooking Condition: Two homes built at the same time might look identical on paper, but one could be carefully maintained and updated, while the other is dilapidated. Condition requires careful observation, often through photos, descriptions, and sometimes even a drive-by.

- Using Active or Pending Listings: These are not actual sales. An asking price is a wish, not a reality. A pending sale is an agreement, but the final price might still change or the deal could fall through. Stick to sold data.

- Not Adjusting for Differences: This is the biggest mistake. If a comparable has an extra bathroom, we don't just ignore it; we estimate the value of that extra bathroom and adjust the comparable's sale price downwards to reflect what it would have sold for without it. This requires local expertise to gauge appropriate adjustment values.

- Relying Solely on Automated Valuations: While convenient, AVMs lack the human element to assess unique features, specific conditions, or the intangible "feel" of a neighborhood. They are a starting point, not the final word.

Beyond the Basics: Comps in Different Contexts

While our focus is primarily on residential real estate, the concept of comparables extends far beyond a single-family home in Fremont. It's a fundamental tool in various valuation methods and market analyses. Understanding these broader applications reinforces the power of comparative analysis. For a general overview of market dynamics and how they relate to valuation, a good starting point is our Market Analysis page.

Comps in Formal Appraisal Approaches

Professional appraisers use comparables within three primary valuation approaches to arrive at a property's fair market value:

-

Sales Comparison Approach (SCA): This is the most common and direct application of comparables. The appraiser finds several recently sold properties that are highly similar to the subject property. They then make dollar adjustments to the sale price of each comparable to account for differences in features, condition, location, and time of sale. The adjusted sales prices are then reconciled to arrive at a final value for the subject property. This approach is heavily weighted in residential appraisals because it directly reflects recent buyer behavior in the market. A minimum of three comparables are typically required for this approach.

-

Cost Approach: This approach estimates the value of a property by determining the cost to replace it new, less depreciation, plus the value of the land. Comparables come into play here when valuing the land itself. Appraisers will look at recent sales of vacant land parcels (land comparables) to determine the market value of the subject property's site. This approach is often used for newer construction or unique properties where sales comparablesare scarce.

-

Income Approach: Primarily used for income-generating properties (like rental homes or apartment buildings), this approach estimates value based on the property's potential to generate income. Here, comparables are used to derive market-based income and expense data, as well as capitalization rates or discount rates from recently sold income properties. This helps appraisers determine what an investor would realistically pay for the income stream the property could produce.

All these approaches are governed by stringent professional standards, such as the Uniform Standards of Professional Appraisal Practice (USPAP) in the U.S., ensuring consistency and credibility in valuations.

Frequently Asked Questions about Real Estate Comparables

We often hear similar questions from our clients about comparables. Here are some of the most common ones, answered with our Bay Area expertise in mind:

How many comps are needed for an accurate valuation?

While a minimum of three comparables is generally considered sufficient for the sales comparison approach in formal appraisals, we typically recommend analyzing between four and six to get a more robust and accurate picture. The more good comparables you have, the better you can identify trends and spot any outliers that might skew your valuation. In a very active market like some parts of the Bay Area, having more data points helps confirm pricing strategies. If data is scarce due to a unique property or slow market, you might need to expand your search criteria slightly, but always prioritize quality and relevance.

What's the difference between a CMA and an appraisal?

This is a crucial distinction!

- Comparative Market Analysis (CMA): This report is prepared by a real estate agent (like us!). Its primary purpose is to help a seller determine a strategic listing price or to help a buyer formulate an offer. CMAs use comparables from the MLS, but they are not formal appraisals and do not provide a legally binding opinion of value. They are an agent's professional opinion, informed by market expertise.

- Appraisal: This is a formal, unbiased, and legally recognized opinion of value prepared by a licensed appraiser. It's typically required by lenders when a property is being purchased or refinanced to ensure the loan amount is justified by the property's value. Appraisals adhere to strict professional standards (USPAP) and carry more legal weight than a CMA. Appraisers also use comparables, but their process is more rigorous and documented.

Can I find my own comps without a real estate agent?

Yes, you absolutely can! Public records, available through your county assessor's office (often online), can provide sale prices for properties. Online real estate portals like Zillow and Realtor.com also have "recently sold" filters that allow you to search for comparables.

However, there are limitations:

- Limited Data: Public records might not include details on property condition, upgrades, or seller concessions, which are vital for accurate adjustments. Online portals can also have outdated or incomplete information.

- MLS Access: The most comprehensive and up-to-date data is typically found in the Multiple Listing Service (MLS), which is exclusively accessible to licensed real estate agents. Agents have tools to filter and analyze comparables with far greater precision.

- Local Expertise: Knowing which comparables are truly relevant, how to adjust for specific differences, and understanding hyper-local market nuances (like school district boundaries or unique neighborhood characteristics) requires extensive local experience. This is where a seasoned Bay Area agent like us provides invaluable insight.

While you can start your research independently, for the most accurate and strategic valuation, especially when making significant financial decisions, partnering with a knowledgeable real estate professional is highly recommended. For more on what sellers should know about value estimates, see A Home Seller's Guide to Real Estate Value Estimates.

Conclusion

Understanding comparables is arguably the most powerful tool in your real estate arsenal. It’s the difference between guessing your home's value and knowing it with confidence. From helping buyers make smart offers in competitive markets like Fremont and Pleasanton, to empowering sellers to price their homes strategically, and guiding appraisers in their objective valuations, comparables are the bedrock of informed real estate decisions.

While the process involves data, statistics, and a keen eye for detail, it also has an art to it—the art of recognizing how subtle differences in a property's story can impact its market appeal. This is where local market expertise, honed over years in the dynamic Bay Area real estate landscape, truly shines.

We pride ourselves on our deep understanding of these local markets and our ability to carefully analyze comparables to provide clear, actionable insights. Don't leave your most significant investment to chance or generic online estimates. To get a precise and professional assessment of your property's value, request a personalized Home Valuation today.